Updated REIT Guidance

As a growing company in the self-storage space, it is important that we track these quarterly metrics because they offer insight into industry trends, while providing a baseline to make our own rent and expense growth assumptions.

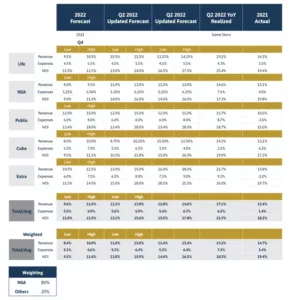

In the chart below, we’ve gathered the revenue, expense and net operating income (NOI) growth each of the major self-storage REITs—Life Storage, National Storage Affiliates, Public Storage, CubeSmart and Extra Space—have recently achieved and their projections for 2022.

The data tells us that guidance overall has improved and REIT sentiment remains positive. National Storage Affiliates (NSA) and Public Storage guidance remain unchanged from Q1, while CubeSmart, Extra Space Storage and Life Storage have all updated their guidance to be even more aggressive.

Extra Space leads the pack with an updated 18% same-store revenue growth for 2022—having realized 21.7% compared to the same period last year. NSA has the lowest guidance at 11% same-store revenue growth and CubeSmart realized the lowest T-12 rent growth at an impressive 14.2%. As a result, updated expense growth projections range from 5.4% to 6.7%.

In addition, the average rent growth projection for this year is about 13.5% (for reference, Spartan underwrites anywhere from 3-8%). Ultimately, these numbers tell us that self-storage has been benefitting from a high-demand and inflationary environment.

The chart below tells the full story, but the headline remains: REIT performance is STRONG and self-storage real estate is a recession-resistant asset class that’s here to stay.