Interest Rates and Their Impact on Real Estate Investments

Introduction

Interest rates play a pivotal role in the real estate market, influencing everything from property prices to investment strategies. As we navigate through 2024, understanding the implications of interest rates on real estate investments is crucial for making informed decisions.

Current Interest Rate Environment

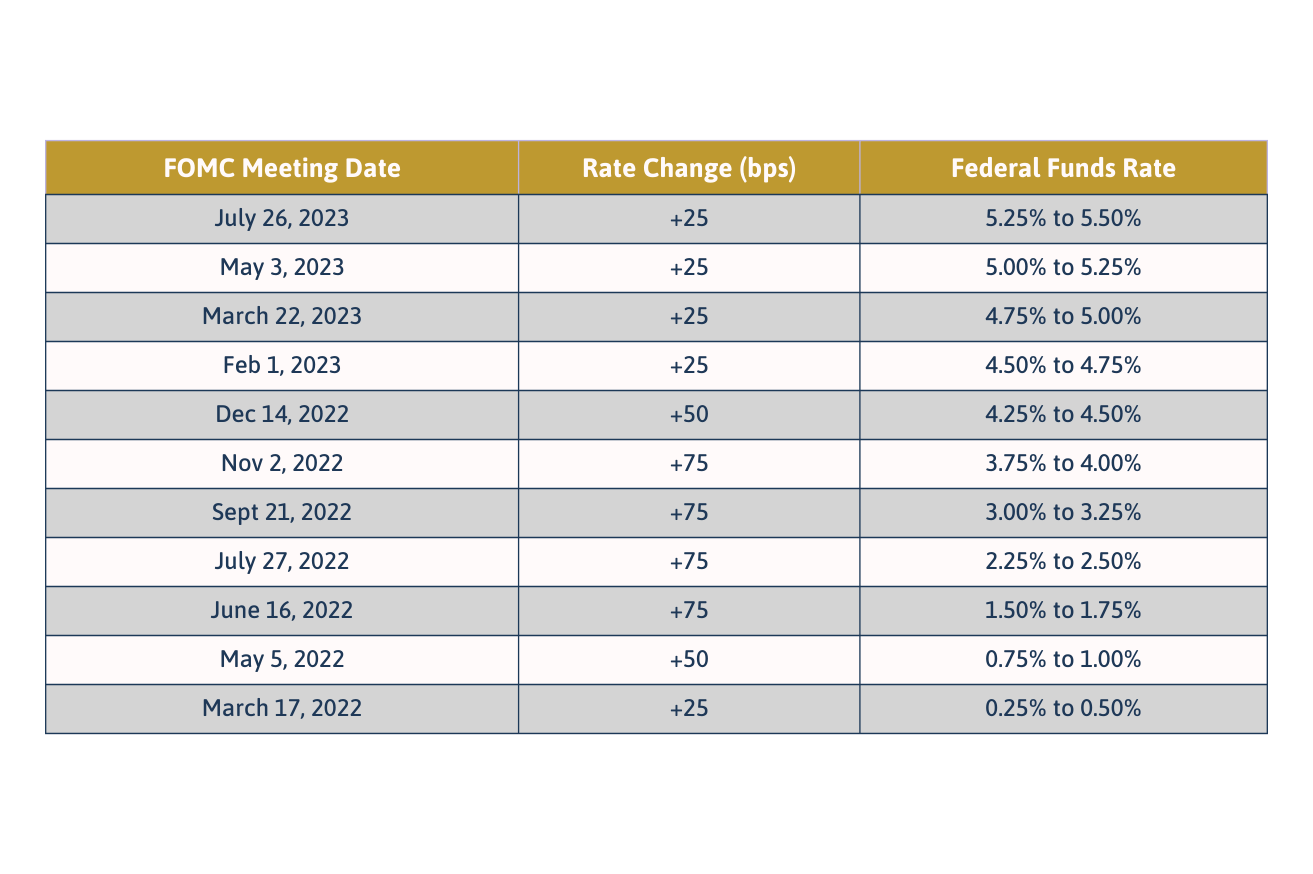

As of July 2024, the interest rate environment has been marked by a series of adjustments from the Federal Reserve, aimed at controlling inflation and stabilizing the economy. The current federal funds rate stands as high as 5.5%, reflecting a series of rate hikes over the past year.

Rate Increase’s Impact on the Economy Historically

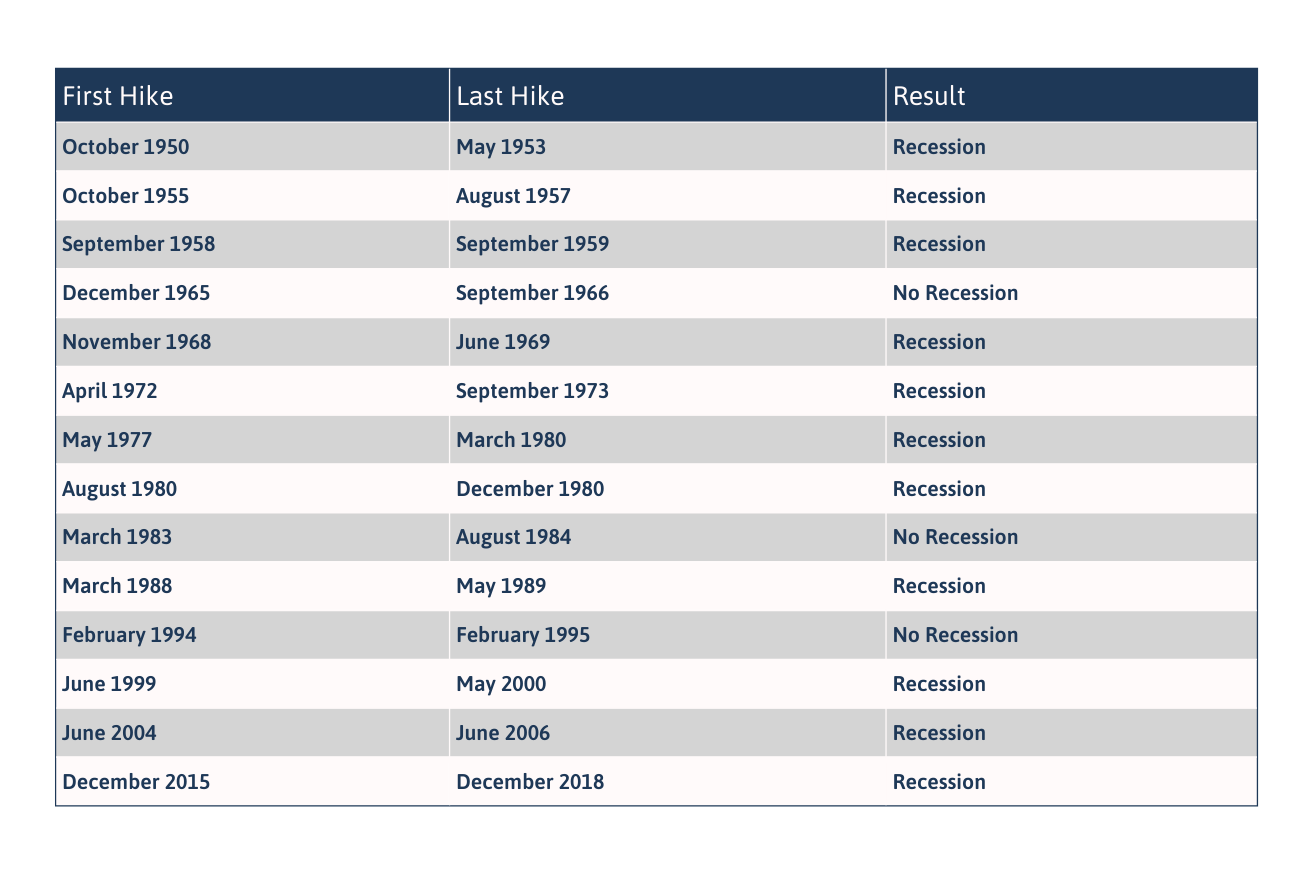

Beginning in the 1950’s there have been 14 rate hike cycles with 11 ending in a recession. When entering a recession, the Fed subsequently lowers the Fed Funds rate – reversing the previous work done while raising rates.

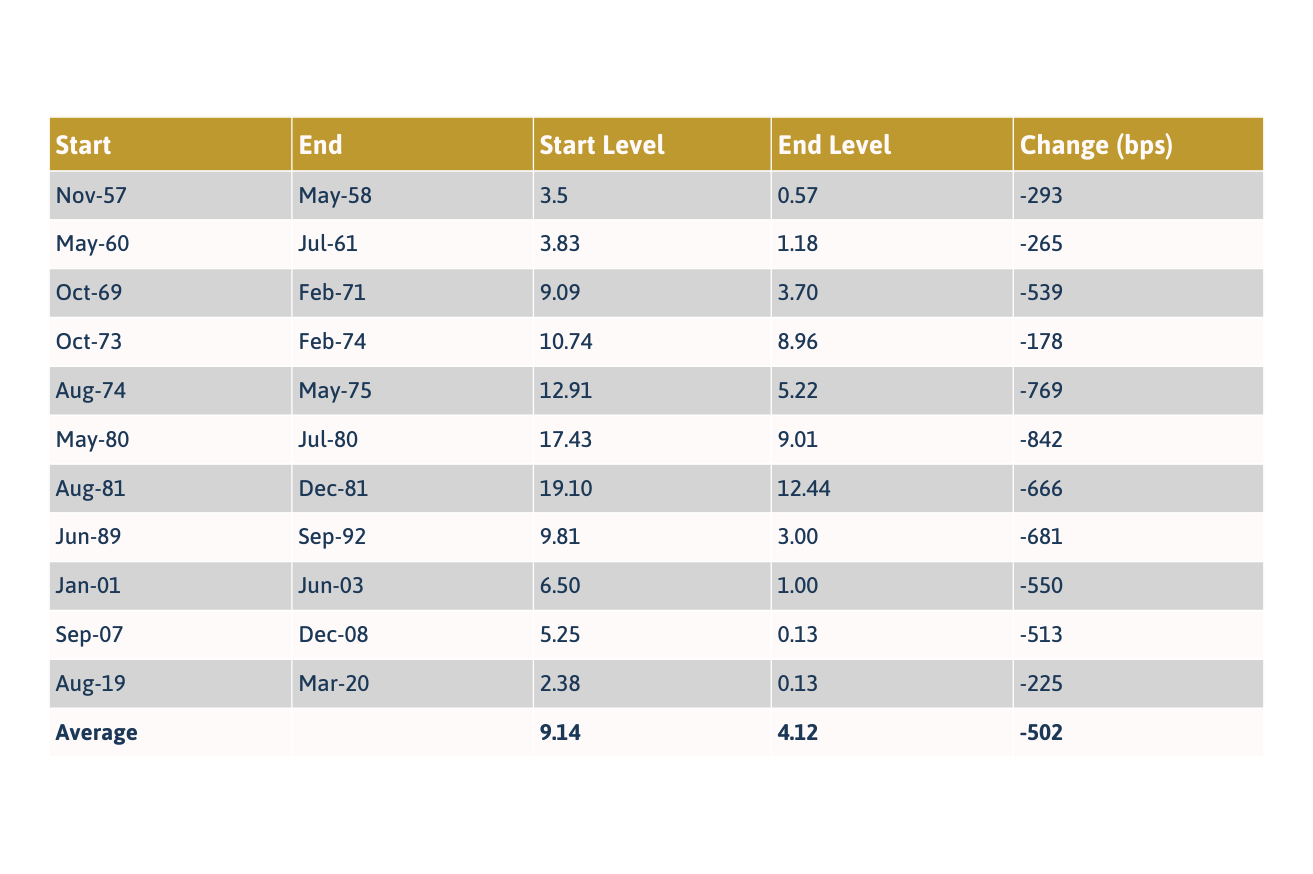

In the below charts we see that the average decline in the Federal Funds rate after a cycle of raising rates – is a decrease of 502 basis points. This is in essence 5%.

These are the periods of time when the Fed raised rates and whether or not the economy went into a recession:

Impact on Real Estate Investments

- Property Prices

- Higher interest rates generally lead to higher mortgage rates, which can reduce the affordability of homes for buyers. This often results in a cooling of the housing market, with slower price appreciation or even price declines in some areas.

- Investment Yields

- For real estate investors, higher interest rates can mean higher borrowing costs, which can reduce overall returns on investment. Investors may need to adjust their yield expectations or seek properties with higher income potential to offset increased financing costs.

- Market Demand

- Increased interest rates can dampen demand for both residential and commercial properties. Buyers and investors may become more cautious, leading to a slower transaction volume and potentially longer time on the market for sellers.

- Financing Strategies

- Investors may explore alternative financing strategies in a high-interest-rate environment, such as locking in fixed-rate loans to hedge against further rate increases or using more equity to reduce dependency on borrowed funds.

Strategic Considerations for Investors

- Focus on Cash Flow

- In times of rising interest rates, properties with strong cash flow become even more valuable. Investors should prioritize acquisitions that offer solid rental income to ensure they can cover higher financing costs and still achieve their desired returns.

- Diversification

- Diversifying across different markets and property types can help mitigate risks associated with rising interest rates. For instance, while residential markets may slow down, certain commercial or industrial properties might remain resilient.

- Value-Add Opportunities

- Properties that offer value-add opportunities, such as renovations or operational improvements, can provide higher returns that may offset increased financing costs. Investors should look for assets where they can create additional value.

- Long-Term Perspective

- Maintaining a long-term perspective can help investors navigate interest rate fluctuations. Real estate is typically a long-term investment, and while higher interest rates may pose short-term challenges, the underlying fundamentals of strong locations and quality properties remain critical.

Conclusion

Looking backwards – the average lag from the onset of the Fed tightening cycle to the recession is 26 months. March of 2022 was the first Fed Funds rate hike during the most recent cycle. 26 months forward would be June of 2024.

Looking back, on the eve of the first rate cut after a tightening cycle began, the lag from the last rate hike to first rate cut has been 10 months. Ten months forward from our last rate increase would be May of 2024. On average, prior to a recession beginning, real GDP growth is north of a 3% annual rate, inflation was bumping 3%, non-farm payrolls was at 150k and unemployment rates hovered just over 4% (quoting economist David Rosenberg who I met at Merrill Lynch in the 1990’s and have followed since). It seems plausible to me the real issue today is the magnitude of a rate cut and not if there will be a rate cut.

Each investor should make their own determination of what this means. It seems to me that a reasonable perspective is there may be a decrease in the pace of economic growth coming as well as a lower interest rate environment ahead.

Remember that the Secured Overnight Funding Rate (SOFR) is a lending rate on many floating rate commercial real-estate loans. The SOFR is tied to the Federal Funds rate. If the Fed starts lowering rates, the affordability of real-estate will be impacted. Use ustreasuryyieldcurve.com to evaluate where the market is currently across the yield curve.

Understanding the impact of interest rates on real estate investments is essential for navigating the current market landscape. By focusing on cash flow, diversifying investments, seeking value-add opportunities, and maintaining a long-term perspective, investors can effectively manage the challenges posed by a high-interest-rate environment.